Introduction

Since last week’s launch, Lore Finance has experienced a significant rise in volume and liquidity, catapulting it to the top 15 protocols on Scroll in market size in only three days. Already, we’ve seen:

- Over $16mm market size

- ~200 unique users

- 1500+ transactions

- Over $50mm in volume

Our initial progress is a good sign but its only just the beginning, and we are extremely excited to embark on this next stage of growth and development alongside the rest of the Scroll ecosystem.

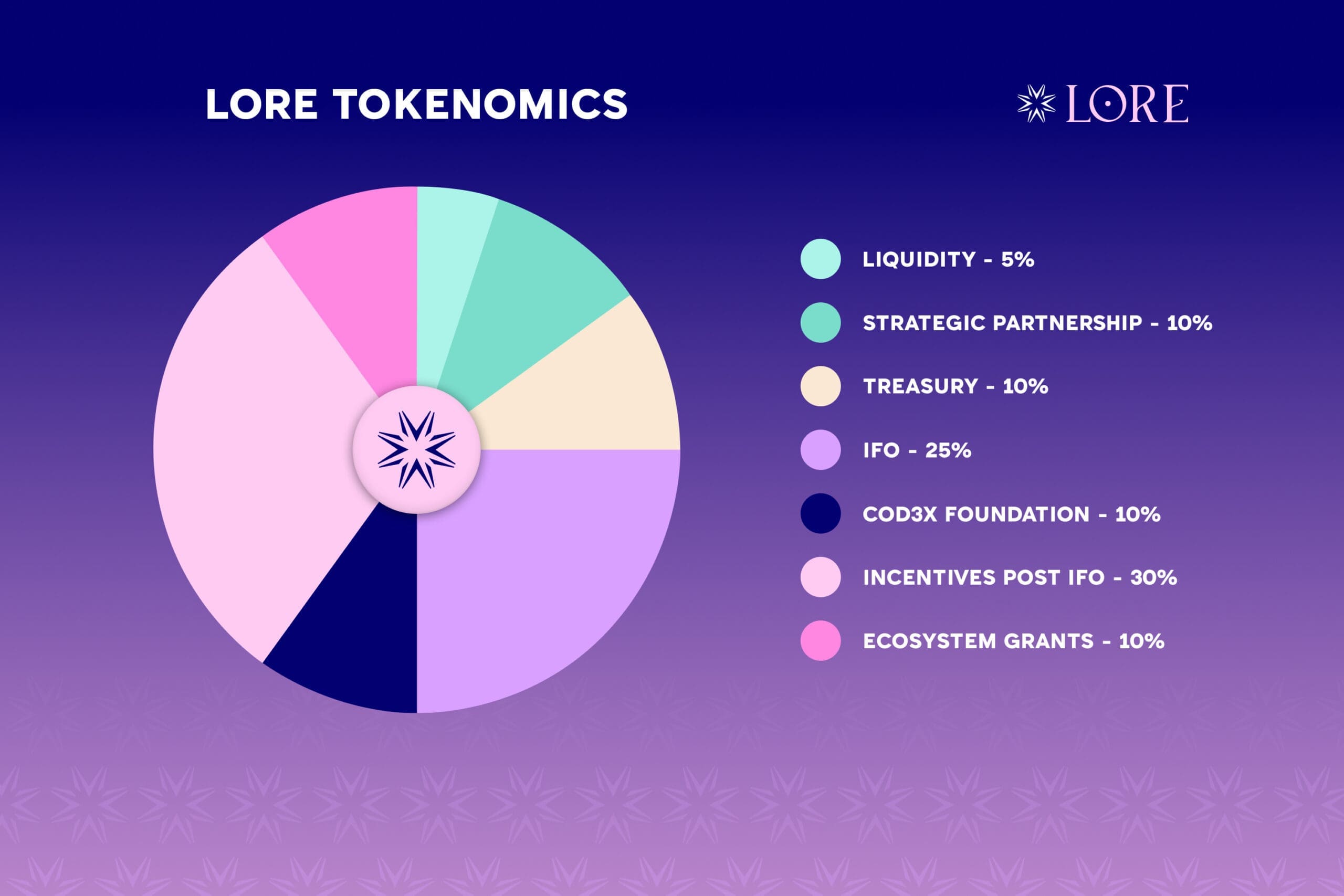

Below you’ll find the tokenomics details for LORE:

Liquidity

Strategic Partnerships

Treasury

IFO

An IFO is an Initial Farm Offering. We will emit 25% of the LORE token over our first 90 days of operations. Instead of having a private sale, a public sale, or an airdrop, we are hitting the ground running and getting the token directly into the hands of our most dedicated users from day 1.

If you want to know more about the IFO, read this article.

Cod3x Foundation

Incentives Post IFO

Ecosystem Grants

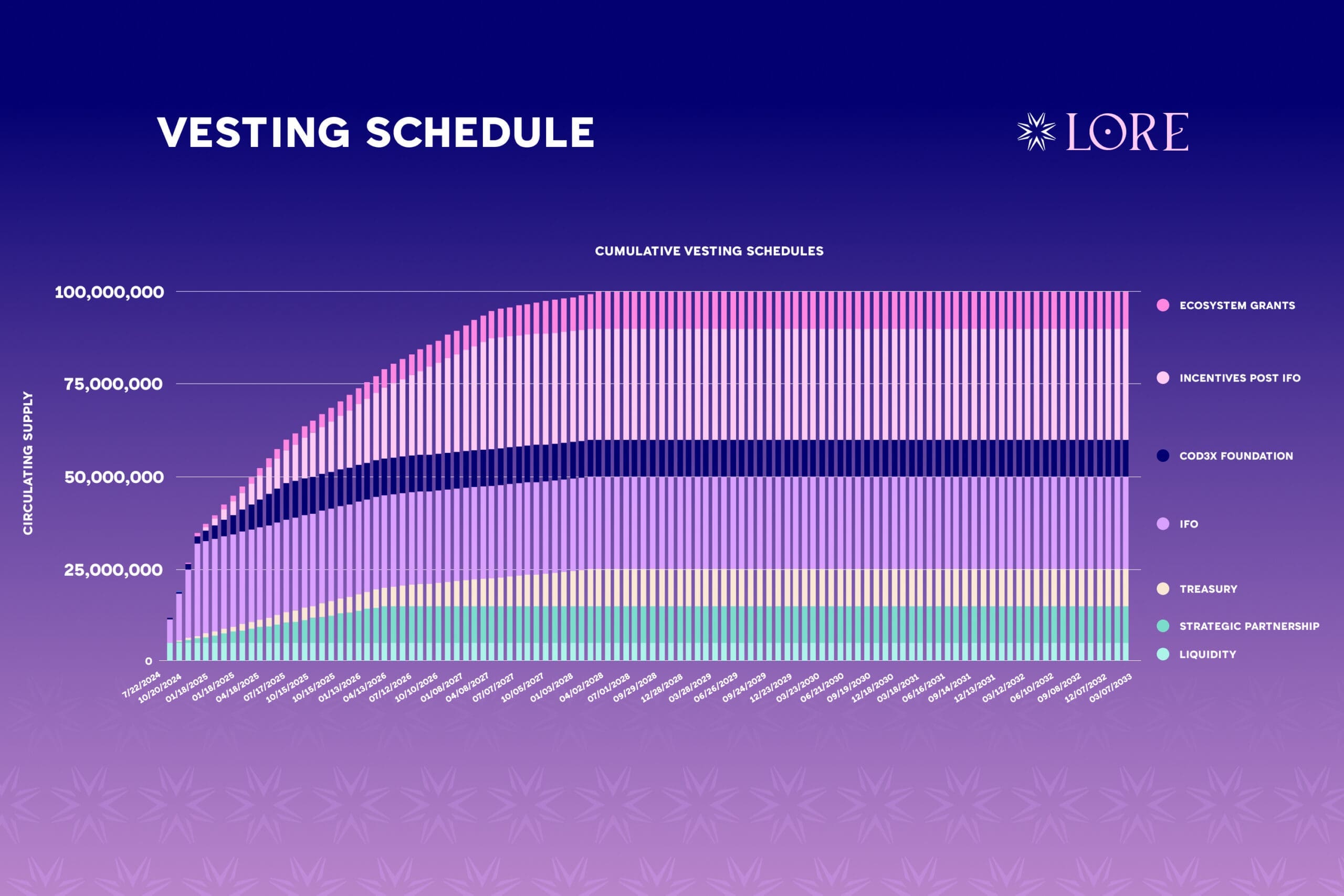

Cumulative Vesting and Emissions

Our approach to token emissions is grounded in the principle that all LORE spent should provide maximum value for the protocol and its governors.

The schedule has been designed to create optimal alignment between the protocol and participants, with the goal of maximizing value and sustainability over long time horizons.

Happy farming!

Write Your Story

We're making DeFi fun again! Join the community.

Harness best-in-class security, stability, and yield opportunities on Scroll, a Native zkEVM ecosystem attracting DeFi’s most talented teams and highest yields. DeFine your own narrative.